Success Story

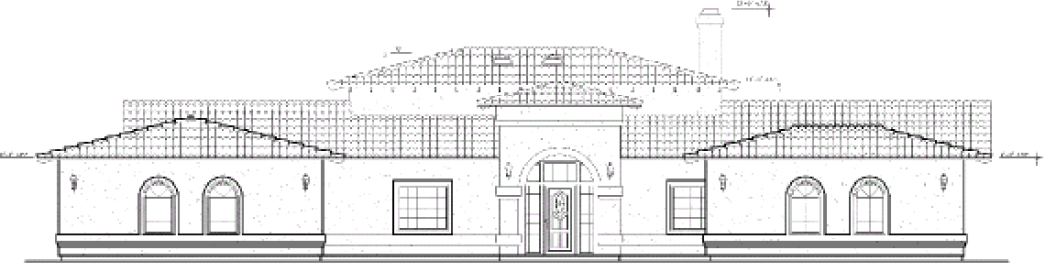

Securing financing as an owner/builder can be a hurdle for many lenders, as they require third-party contractors. In this case, an experienced general contractor and real estate investor sought funding to build a single-family residence but needed a lender that understood and supported owner/builder projects. With a strong track record of building residential properties, the borrower required a loan structure that would allow them to maintain control of the construction process while ensuring efficient fund management.

Fidelis Private Fund provided a $550,000 1st Trust Deed construction loan, supporting the borrower’s ability to act as both developer and builder. With an estimated completed value of $1,100,000, the conservative Loan-to-Value (LTV) ratio is just 50%. The funds will be funded through a third-party fund control.

Exit Strategy

The borrower plans to sell the completed property, leveraging its substantial market value to generate a profitable return.

Value Added

Fidelis provided financing for an owner/builder with the flexibility and support needed to complete their developments successfully. By offering tailored funding solutions and working with experienced fund control partners, Fidelis enables real estate investors to unlock maximum value while maintaining control over their construction process.

Another transaction where Fidelis Private Fund is helping our clients achieve their financial goals.