In real estate development, speed is more than just a convenience—it’s a competitive edge. Delays in financing can mean missed opportunities, lost profits, and stalled projects. Traditional lenders often impose lengthy approval processes, rigid requirements, and bureaucratic red tape that can slow developers down. This is where private lending offers a game-changing solution, providing quick access to capital with the flexibility developers need to close deals efficiently.

The Need for Speed in Real Estate

Timing is everything in real estate. Whether acquiring a new property, financing a construction project, or securing a bridge loan, developers need rapid financing solutions to stay ahead of the competition. Traditional banks can take weeks, if not months, to approve loans—by which time, the best deals may be off the table.

Private lenders like Fidelis Private Fund recognize this urgency and provide fast, strategic financing tailored to the unique needs of real estate professionals. Our streamlined underwriting process ensures funding decisions in just days, allowing developers to seize opportunities before they disappear.

How Private Lending Accelerates Deals

- Streamlined Approval Process

Unlike traditional lenders that require extensive documentation, appraisals, and committee approvals, private lenders operate with efficiency. At Fidelis, we focus on the property’s potential and the borrower’s experience rather than just credit scores and exhaustive paperwork. This results in faster decision-making and quicker access to capital. - Flexible Loan Structures

Traditional loans come with rigid terms that may not align with the dynamic needs of developers. Private lenders offer tailored solutions, including short-term bridge loans, construction financing, and value-add project funding. Fidelis Private Fund works closely with borrowers to structure loans that align with their project timelines and investment goals. - Certainty of Execution

A bank loan approval does not always guarantee funding. Last-minute changes in underwriting criteria, shifting market conditions, or internal policy shifts can lead to delays or outright denials. Private lenders, however, offer reliable funding commitments that developers can count on. At Fidelis, we prioritize transparency and follow through on our funding promises, ensuring that deals close smoothly.

Why Developers Choose Private Lending Over Banks

Why Developers Choose Private Lending Over Banks

-

Speed: Quick access to capital means developers can act decisively in competitive markets.

-

Flexibility: Customized loan terms allow for strategic financial planning.

-

Reliability: Less bureaucracy and greater certainty in funding commitments.

-

Relationship-Based Lending: Working with a private lender like Fidelis fosters long-term partnerships that prioritize the borrower’s success.

Fidelis Private Fund: Your Partner in Fast & Flexible Financing

At Fidelis Private Fund, we empower developers with strategic financing solutions designed for speed, flexibility, and long-term success. Whether you need a bridge loan, construction financing, or a tailored funding solution for your next project, we provide the capital and expertise to help you close deals faster.

For personalized guidance, connect with our team today. Call Fidelis Private Fund now at 760-258-4486 and schedule a meeting with our experts to discuss your investment goals. Our experienced team has helped countless investors navigate market uncertainty and build resilient portfolios with confidence. Let’s build a resilient financial future together.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

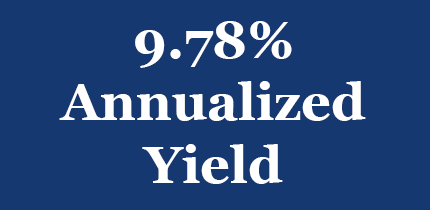

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.