The Shift Toward Stability in Uncertain Markets

Institutional investors constantly seek asset classes that offer stable returns with lower volatility. According to a recent Institutional Investor report, alternative investments like mortgage funds have seen a 20% increase in institutional allocations over the past five years, highlighting their growing appeal in volatile markets. In today’s rapidly changing economic environment, mortgage funds, such as those offered by Fidelis Private Fund, have emerged as a preferred safe haven. Unlike traditional stocks and bonds, mortgage funds provide a unique combination of asset-backed security, consistent income, and risk-adjusted returns.

Why Mortgage Funds Appeal to Institutional Investors

- Stability in a Volatile Market

Stock market fluctuations and economic uncertainty have made traditional investment vehicles increasingly unpredictable. Mortgage funds, backed by tangible real estate assets such as commercial properties and residential developments with strong equity positions, provide a level of security that institutional investors find reassuring. These assets serve as collateral, reducing the risk of capital loss and enhancing portfolio stability. These funds generate predictable returns without being directly correlated to public market volatility. - Diversification and Risk Mitigation

Institutional investors rely on diversification to minimize risk. While mortgage funds offer stability, they also come with potential risks such as market downturns impacting real estate values, borrower defaults, and liquidity constraints. A thorough due diligence process and conservative underwriting standards help mitigate these challenges. Mortgage funds, like those managed by Fidelis Private Fund, serve as an effective hedge against stock market downturns, offering a portfolio component with lower correlation to equities. Additionally, well-managed mortgage funds carefully balance risk by underwriting loans with conservative loan-to-value (LTV) ratios, further protecting investor capital. - Consistent Passive Income

Unlike speculative investments, mortgage funds generate reliable passive income through interest payments on secured loans. Fidelis Private Fund specializes in structuring loans that align with institutional investors’ need for steady cash flow while mitigating exposure to market volatility. This makes them particularly attractive to pension funds, endowments, and insurance companies looking for stable cash flow to meet their long-term obligations. - Inflation Protection

Rising inflation erodes the purchasing power of fixed-income investments. However, mortgage funds often benefit in inflationary environments as real estate-backed loans adjust to market conditions, allowing lenders to maintain competitive yields. - Institutional-Level Due Diligence and Transparency

Top mortgage funds, including Fidelis Private Fund, employ rigorous underwriting standards and risk assessment processes. Fidelis Private Fund carefully evaluates each loan, ensuring conservative loan-to-value ratios and thorough borrower due diligence to minimize risk. Additionally, Fidelis maintains a diversified portfolio of real estate-backed loans, providing institutional investors with stability and predictable returns, aligning with the institutional investor’s demand for transparency and accountability. Investors gain confidence knowing that these funds operate under structured lending criteria, with experienced professionals managing loan portfolios.

The Future of Institutional Investment in Mortgage Funds

As market conditions continue to shift, institutional capital is expected to flow more heavily into mortgage funds, according to recent reports from the National Association of Real Estate Investment Trusts (NAREIT) and Institutional Investor, which highlight the

growing preference for private lending as a stable alternative investment. With increasing demand for alternative investments that offer security, consistent returns, and risk-adjusted performance, mortgage funds are well-positioned to remain a go-to choice for institutional investors looking to safeguard capital.

Explore Secure Mortgage Fund Investment Opportunities

If you are an institutional investor looking for stable, asset-backed returns, mortgage funds could be the strategic addition your portfolio needs. Contact Fidelis Private Fund today at 760-258-4486 to learn more about how our mortgage fund solutions align with your investment objectives. Our team is committed to transp

arency, competitive fee structures, and proactive risk management to ensure your capital is safeguarded with confidence. We encourage you to reach out and speak with our experts directly. Our team is committed to transparency, competitive fee structures, and proactive risk manageme

nt to ensure your capital is safeguarded with confidence.

Related Resources

External References

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

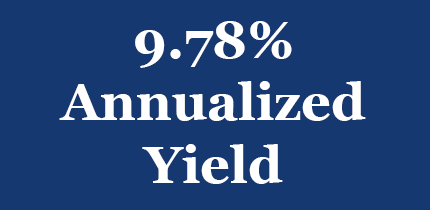

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.