The fee structure is a critical component in real estate mortgage funds that can significantly impact investor returns. At Fidelis Private Fund, we’ve adopted a fee structure that aligns our aspirations with our investors, ensuring our mutual growth is linked. AdobeStock_527169980.jpeg

A Unique Approach to Management Fees

Diverging from the common practice among mortgage funds of charging management fees based on total assets, Fidelis adopts a distinct approach by calculating our fee as 15% of the fund’s net income. This leaves 85% of the net income for our investors. By directly linking our earnings to the fund’s profitability, our interests align with those of our investors.

Mutual Growth and Success

Our fee structure is not just about mutual growth, it’s about your growth. By aligning our compensation with the fund’s performance, we are motivated to focus on strategies that enhance the profitability and overall success of the fund. This means diligent asset selection, effective risk management, and proactive fund oversight, all aimed at maximizing returns for our valued investors.

Conclusion

At Fidelis Private Fund, our fee structure is more than just a structure-it’s a commitment to our shared success. By basing our fees on net income, we ensure our success is directly tied to our investors.

We invite you to join us at Fidelis, where our fee structure is a testament to our dedication to your financial prosperity and our joint venture toward long-term wealth accumulation.

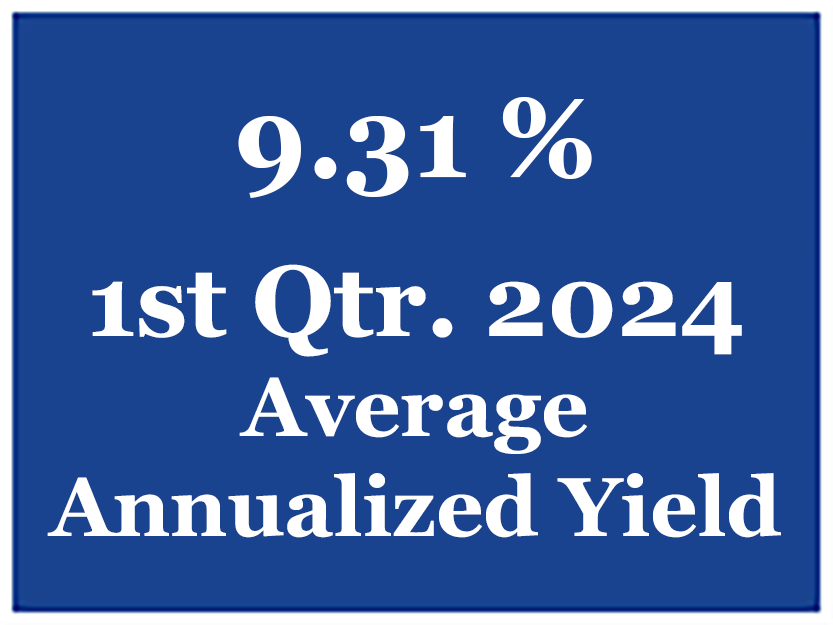

Fidelis Private Fund annualized yield paid to Limited Partners for the first quarter of 2024 was 9.31%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the first quarter of 2024 was 9.31%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.