$500,000 Refinance/Bridge Loan

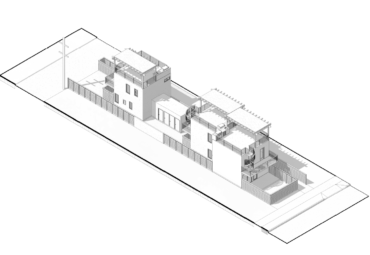

A repeat client who owned a mixed-use commercial property free and clear located in Spring Valley, CA, needed a loan to purchase the liquor store business that had leased the property for over 15 years. The improvements include a liquor store and a residential rental unit.