$1,860,000 Refi./Construction Loan

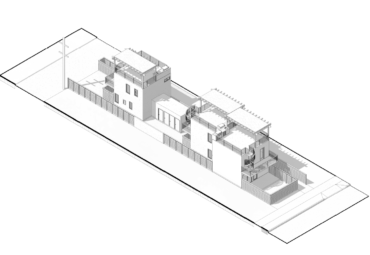

A repeat client needed a refinance/construction loan to pay off a private money loan secured by single-family investment property on a large lot. The borrower plans to remodel and obtain permits to add five additional rental units for a total 6-unit multi-family project.