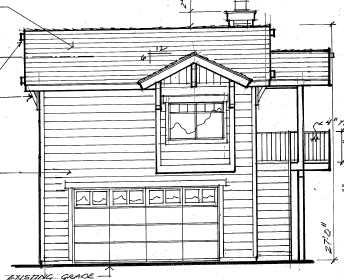

$700,000 Purchase/Bridge Loan

A repeat client purchased a residential investment property all cash and subsequently needed to refinance cash-out loan to purchase another investment property. The borrower wanted a creative and flexible bridge lender to utilize the equity in his existing property to purchase another investment...