Fidelis Funded Loans

Fidelis Private Fund provides bridge financing for a number of different property types and situations. We aim to provide value through rapid decisions, creative solutions, and timely execution. Below are some examples of funded transactions along with the corresponding stories. If one of these stories piques your interest and you’d like to learn more or explore how we may help you, please contact us.

$2,100,000 1st DOT Purchase/Bridge Loan

An experienced real estate investor needed to secure financing for the acquisition of two adjacent properties, SFR and a duplex in an excellent location in San Diego, with significant development potential. With a tight closing deadline of just a few weeks, traditional lending options were not viable. The investor required a lender that could move quickly while recognizing the long-term value of the properties.

$550,000 1st DOT Refinance/Const. Loan

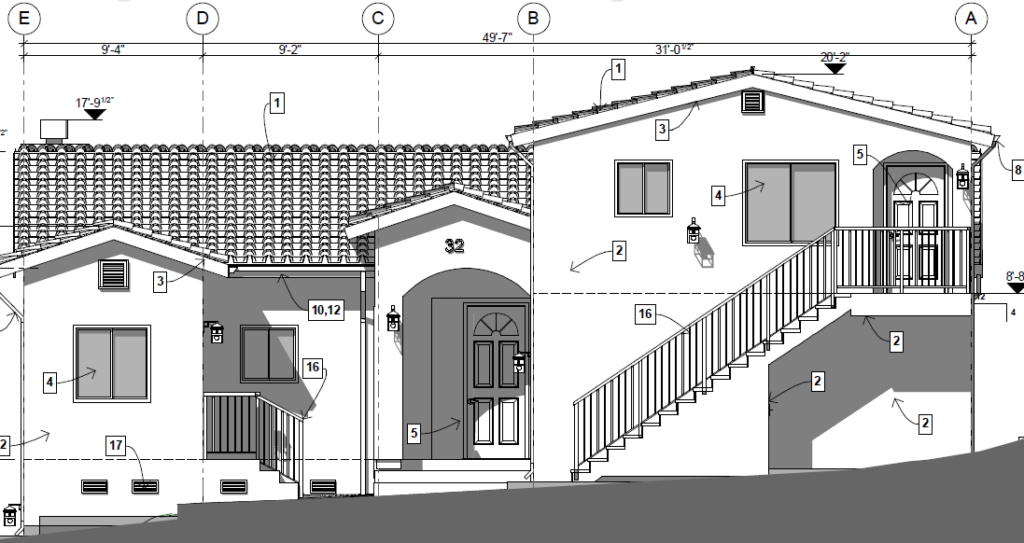

Securing financing as an owner/builder can be a hurdle for many lenders, as they require third-party contractors. In this case, an experienced general contractor and real estate investor sought funding to build a single-family residence but needed a lender that understood and supported owner/builder projects. With a strong track record of building residential properties, the borrower required a loan structure that would allow them to maintain control of the construction process while ensuring efficient fund management.

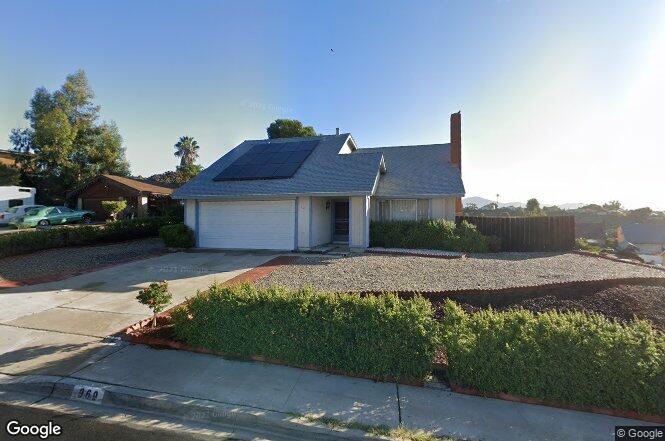

$900,000 1st DOT Purchase/Bridge Loan

A well-qualified borrower sought financing to purchase a new single-family residence while awaiting the sale of an existing property. With strong credit, a high net worth, and significant home equity, the borrower needed a short-term solution to bridge the timing gap between transactions.

$525,000 2nd DOT Refinance/Const. Loan

A real estate investor faced the challenge of converting a duplex in the Pacific Beach Community of San Diego into a five-unit apartment building while simultaneously paying off some debt. The investor required flexible financing to cover construction costs, consolidate existing debt, and maximize the property’s income potential.

$535,000 1st DOT Purchase/Bridge Loan

An experienced real estate broker and past client needed to close quickly on a purchase of a single-family residential investment property in probate at a below-market price. With limited time to close, conventional lending was not an option.

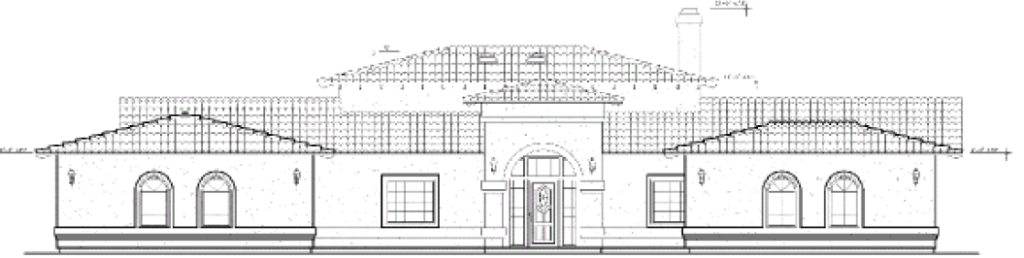

$1,980,000 1st DOT Refinance/Const. Loan

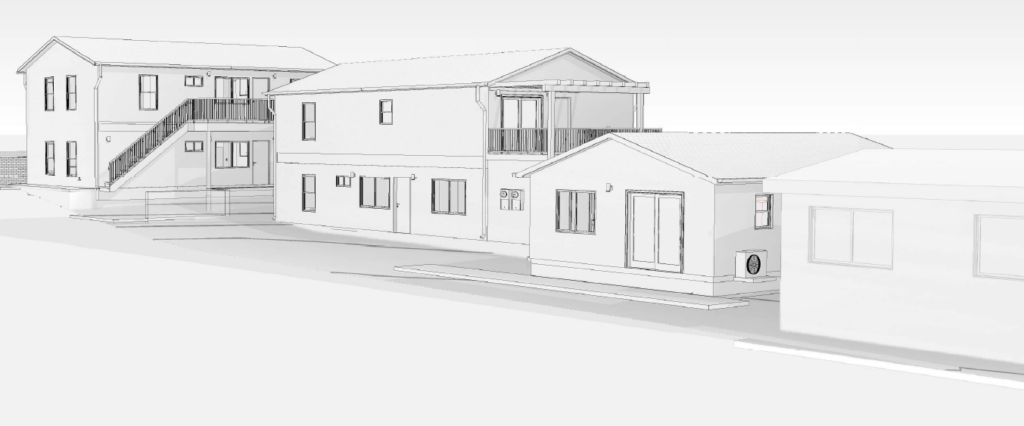

A borrower with a proven track record of developing successful real estate projects in San Diego needed a construction loan to develop a multi-family project.

$1,000,000 2nd DOT Refinance/Bridge Loan

Fidelis Private Fund provided a cash-out refinance loan for an experienced real estate investor and seasoned technology executive. The loan was structured to enhance the borrower’s liquidity, enabling them to secure financing for an upcoming project. The borrower, a respected professional in the tech industry, leveraged their expertise and a strong recommendation from a trusted mortgage broker.

$250,000 1st DOT Refinance/Bridge Loan

Fidelis Private Fund provided financing to a real estate investor, enabling the replenishment of reserves while leveraging a high-quality medical office condominium. The unit, located in an established commercial area, is part of a portfolio managed by a seasoned operator with extensive experience in medical property ownership.

$1,300,000 2nd DOT Refinance/Bridge Loan

Fidelis Private Fund provided financing for an experienced real estate investor to renovate and enhance an 18-room boutique hotel in Mission Beach, San Diego. The property underwent extensive upgrades, including modernized bathrooms, kitchenettes, flooring, landscaping, and new furnishings, significantly boosting its value and market appeal.

$910,000 1st DOT Purchase/Bridge Loan

Fidelis Private Fund facilitated financing for the acquisition of a commercial property supported by cross-collateralized property. The primary property, a brand-new 6,264-square-foot facility with a shop and office space, represents the primary collateral. To further secure the loan, a secondary property owned by the borrower, a 12,258-square-foot industrial office/warehouse in San Diego, CA, was cross-collateralized.

$500,000 1st DOT Refinance/Bridge Loan

Fidelis Private Fund provided financing to a financially stable real estate investor to remodel a rental property and prepare it for sale. The borrower, a Santa Cruz resident with significant real estate holdings and strong monthly rental income, sought funding to maximize the property’s value through targeted renovations.

$630,000 1st DOT Purchase/Bridge Loan

Fidelis Private Fund provided financing for the purchase of a single-family residential investment property with strong value-added potential. The site is 0.44-acre lot, purchased for the potential for future development.

$727,000 1st DOT Purchase/Bridge Loan

Fidelis Private Fund provided financing for the purchase of a single-family residential investment property, presenting an excellent opportunity for value creation in Spring Valley, CA just east of San Diego. The property features 4 bedrooms, 3 bathrooms, and over 3,300 square feet of living space on a large 0.44-acre lot, offering significant upside potential through strategic renovations.

$1,840,000 1st DOT Refinance/Const. Loan

A seasoned real estate investor and repeat client needed construction financing to transform a single-family residence into a six-unit multi-family residential complex. This innovative development project will add significant value to the property and provide much-needed housing units in the San Diego market.

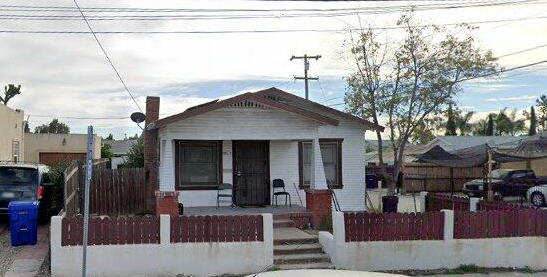

$345,000 1st DOT Purchase/Bridge Loan

Experienced real estate investors and repeat Fidelis clients needed financing to acquire a single-family residence in the city of San Diego. The borrowers intend to convert it into a multi-unit ADU development, maximizing the property’s potential value.

$730,000 1st DOT Refinance/Bridge Loan

An experienced real estate investor and business owner approached Fidelis to refinance an existing loan on a single-tenant retail property. The borrower plans to operate the property as an owner-occupied commercial property, leveraging its prime location and established business potential.

$217,500 1st DOT Purchase/Bridge Loan

A repeat borrower, experienced general contractor, and real estate investor, requested financing for the acquisition of a vacant residential lot. With a proven track record of building and selling residential properties, the borrower plans to build a single-family home on the site to maximize its value.

$2,487,000 1st DOT Refinance/Const. Loan

A repeat client and experienced real estate investor requested a construction loan to transform a single family property into a multi-unit investment. The project involves converting an existing single-family residence into a duplex and constructing six additional ADUs, resulting in eight rentable units. This creative redevelopment maximizes the property’s potential and enhances its value.

$3,160,000 1st DOT Purchase/Bridge Loan

An existing repeat client, real estate investor, and business owner needed financing to purchase an income-generating investment property located in San Diego, CA. The property features a gas station (Circle K) and a fast food restaurant, both operating under long-term leases, with excellent rental income for the borrower.

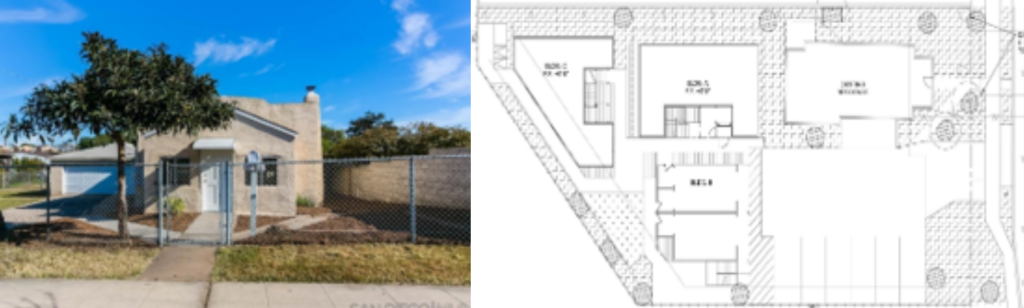

$1,300,000 2nd DOT Refinance/Const. Loan

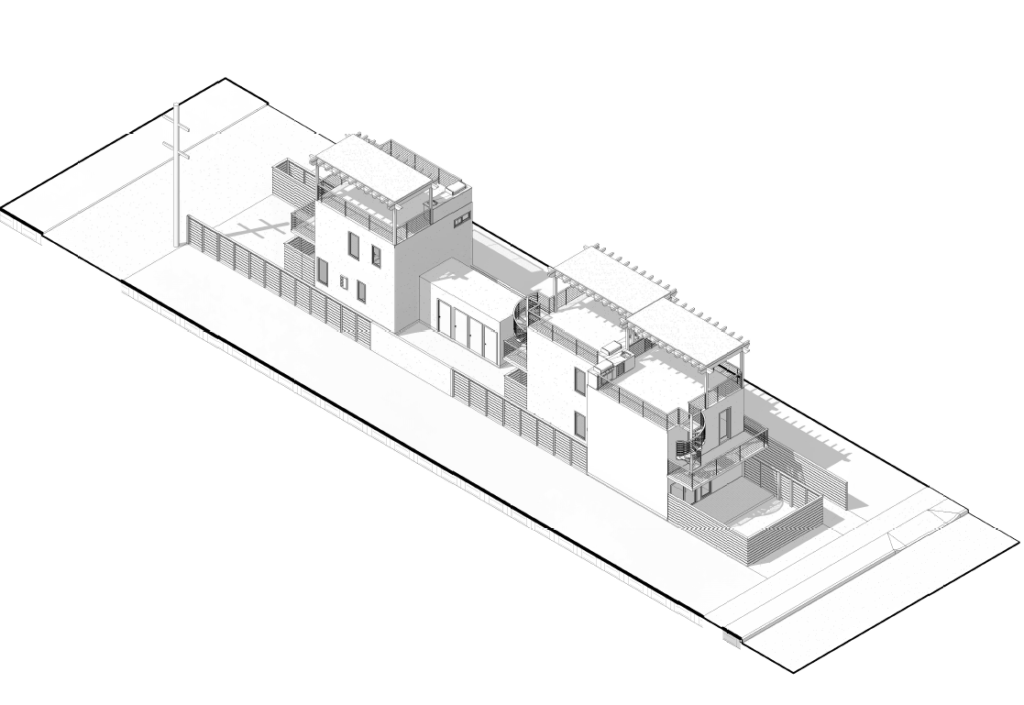

A seasoned client requested a construction loan to transform a single-family property into a dynamic multi-family investment. The subject property, acquired earlier this year, features a 3-bedroom, 2-bathroom residence on a 9,380 sq. ft. lot. The proposed project involves constructing eight 2-bedroom, 1-bathroom ADUs within four new two-story structures, creating a total of nine units and 5,150 sq. ft. of net rentable area.

$318,750 1st DOT Purchase/Bridge Loan

Experienced real estate investors and repeat Fidelis clients needed financing to acquire a single-family residence in the city of San Diego. The borrowers intend to convert it into a multi-unit ADU development, maximizing the property’s potential value.

$210,000 1st DOT Purchase/Bridge Loan

A repeat client and seasoned general contractor needed financing to purchase two residential lots, leveraging an existing single-family residence as additional collateral. The borrower plans to build on the lots for future residential development, enhancing value in the growing Spring Valley area.

$590,000 1st DOT Purchase/Bridge Loan

Repeat clients and seasoned real estate investors partnered requested financing to purchase and renovate a single-family investment property in South Park a community of San Diego. They intend to capitalize on their expertise in property rehabilitation to enhance the home’s value for resale.

$875,000 1st DOT Refinance/Bridge Loan

An experienced investor requested financing to refinance an existing loan and facilitate the purchase of a mixed-use income property. The transaction includes paying off an existing loan, providing a cash-out component, and securing a new loan structure under a newly formed entity.

$350,000 1st DOT Refinance/Const. Loan

An existing client referred an owner/builder to Fidelis who was in the process of constructing a single-family investment property in San Diego County. With the project nearly 65% complete, the borrower needed additional funds to finish the construction.

$620,000 1st DOT Refinance/Bridge Loan

A repeat client from San Diego was refinancing a fully leased commercial investment property in Winchester, CA, using a bridge loan while evaluating options for expanding the property to increase its value.

$527,000 1st DOT Purchase/Bridge Loan

A repeat client needed to quickly close on a single-family residential investment property in El Cajon, CA, for a fix-and-flip project. The borrower will cover the cost of property improvements out of pocket.

$500,000 1st DOT Purchase/Bridge Loan

A referred client needed to quickly close on a single-family residential investment property in San Diego, CA, for a fix-and-flip project. The borrower will cover the cost of property improvements out of pocket.

$2,980,000 1st DOT Refinance/Const. Loan

A repeat client and experienced real estate developer requested a construction loan to refinance an existing acquisition loan of a single-family residence in San Diego that is being converted into two units with plans to build another 10 ADU’s for 12 multi-family units.

$561,500 1st DOT Purchase/Bridge Loan

A returning client and experienced real estate investor required a fast closing to acquire and obtain funds to remodel a 3BR/2BA residential single-family investment property in San Diego. This property holds the potential for increased value with an extensive remodel.

$424,000 1st DOT Purchase/Bridge Loan

Success Story A client needed to close in less than seven days on the acquisition of a single-family residence just east of the North Park neighborhood in San Diego. The borrower needed a quick close on a purchase loan of a below-market property to remodel the house and add an ADU at the rear of […]

$762,000 1st DOT Purchase/Bridge Loan

Success Story A client owned a residential lot in Vista, CA, which was unusable due to its size and topography unless combined with the adjacent property. When the adjacent property, a single-family residence, went up for sale, the borrower needed a purchase loan within days to acquire it, along with additional funds for remodeling and […]

$250,000 2nd DOT Refinance/Bridge Loan

Success Story A client referral needed a fast-closing loan to pull out cash for remodeling four multi-family units in preparation for selling a property in Anaheim, CA. The property had a conservative first trust deed mortgage of $263,000. Fidelis Private Fund provided a $250,000 2nd trust deed refinance cash-out loan for the cosmetic remodel, with […]

$1,700,000 Purchase/Bridge Loan

Success Story A repeat client requested a loan to purchase an owner-occupied office building. The borrower secured the property at a significantly below-market price of $1,685,000, which equates to $144 per square foot. The actual market value exceeds $2,000,000, and after the borrower invests in remodeling with their own funds, the value is expected to […]

$250,000 2nd DOT Refinance-Cashout/Bridge Loan

A Fidelis investor was facing a timing challenge. He needed to close on purchasing another investment property and needed some additional cash to close. The request was to tap the equity in his house for the business-purpose loan.

$3,000,000 1st DOT Purchase/Bridge Loan

A repeat client required financing for constructing 13 ADUs (Accessory Dwelling Units) as a multi-family project in San Diego. Fidelis Private Fund already had an existing loan in place, which we seamlessly modified to support the construction of this project.

$2,200,000 1st DOT Purchase/Bridge Loan

A repeat client needed a fast-closing loan to purchase an existing 10-unit apartment building in the community of North Park in the city of San Diego and didn’t have time to secure conventional financing. The property required updating, and the borrower plans to remodel the units with their own funds and raise rent to market rates, significantly increasing the property’s value. Fidelis stepped in to provide the necessary acquisition financing to meet the borrower’s deadline.

$1,825,000 1st DOT Refi./Const. Bridge Loan

A repeat client requested a modification and additional advance on a $480,000 acquisition loan Fidelis Private Fund previously provided for a single-family residence. Now that the client has received building permits to construct four additional dwelling units (ADUs) and convert the existing residence into two units, for a total of six multi-family units. Fidelis agreed to modify the existing note and provide additional funds for construction for a new increased total loan commitment of $1,825,000.

$512,000 1st DOT Purchase/Bridge Loan

A referred client needed to quickly close on a single-family residential investment property in Chula Vista, CA, for a fix-and-flip project. The borrower will cover the cost of property improvements out of pocket.

$772,500 1st DOT Purchase/Bridge Loan

A repeat client and experienced real estate investor wanted to tap into his existing real estate equity to purchase a single family residential investment property in Chula Vista, CA as a fix and flip with almost no cash down. The borrower owned other investment properties with substantial equity and allowed the properties to be cross-collateralized in lieu of a cash down payment. The borrower will come out of pocket to make the improvements to the property.

$1,575,000 1st DOT Refinance/Const. Loan

A repeat client was seeking a reliable construction lender to fund the construction of eight accessory dwelling units (ADU) in three detached buildings on a property in San Diego, CA. The project also incorporates a detached single-family residence, bringing the total to nine multi-family units upon completion.

$880,000 1st DOT Purchase/Bridge Loan

An experienced real estate investor and current Fidelis client needed to close quickly on the purchase of an older, dilapidated residential investment property in the Sherman Heights neighborhood, near downtown San Diego, CA. This property, bought at a below-market price, was marketed as a single-family residence but was actually permitted as a triplex.

$550,000 1st DOT Purchase/Bridge Loan

A repeat client and experienced real estate investor wanted to tap into his existing real estate equity to purchase a single family residential investment property in Chula Vista, CA as a fix and flip with almost no cash down. The borrower owned other investment properties with substantial equity and allowed the properties to be cross-collateralized in lieu of a cash down payment. The borrower will come out of pocket to make the improvements to the property.

$1,900,000 1st DOT Purchase/Const. Loan

A referred client was seeking a reliable construction lender to fund the construction of five accessory dwelling units (ADU) in three detached buildings on a property in San Diego, CA. The project also incorporates a newly remodeled single-family residence, bringing the total to six multi-family units upon completion.

$130,000 2nd DOT Cash-Out/Bridge Loan

A repeat client who owned a single-family investment property valued at over $700,000 initiated plans to develop a six-unit multifamily building on the site in San Marcos, CA. In order to finance the early development costs, the client needed a bridge loan. The property was already encumbered by a low-cost first trust deed loan of less than $230,000. To avoid paying off this low-cost mortgage, the borrower requested a second trust deed loan of $130,000 specifically for the development costs. Once the building permits are approved, the client plans to secure a construction loan, which will then be used to repay the second trust deed loan.

$2,365,000 1st DOT Refinance/Const. Loan

A repeat client requested a modification and additional advance on a $670,250 acquisition loan Fidelis Private Fund previously provided for a single-family residence in San Diego, CA. Now that the client has received building permits to construct six additional dwelling units (ADUs) and convert the existing residence into two units, for a total of eight multi-family units. Fidelis agreed to modify the existing note and provide additional funds for construction for a new increased total loan commitment of $2,365,000.

$1,350,000 1st DOT Refinance/Bridge Loan

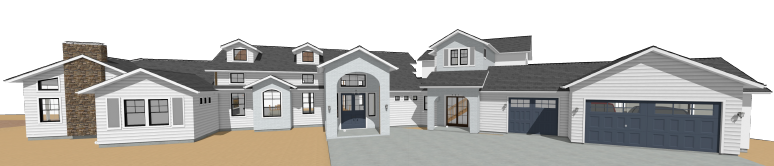

A referral from a Fidelis limited partner required additional funds to complete the construction of a single-family residence in Rancho Santa Fe, CA. The project was about 85% complete when Fidelis stepped in to provide the necessary funds to finish construction.

$850,000 1st DOT Refinance/Bridge Loan

A well-established brokerage client who has worked with Fidelis before represented a customer seeking a bridge loan. The purpose of the loan was to renovate and secure new tenants for a multi-tenant industrial office/warehouse complex in San Diego. This property includes three parcels and multiple buildings, with more than 26,000 square feet, and was owned free and clear with no debt.

$550,000 1st DOT Refinance/Bridge Loan

A reputable repeat brokerage client approached Fidelis because their client was facing a timing challenge. The client needed to close on the purchase of a property before the sale of another property had sold, which was intended to provide the down payment on the purchase. Fidelis stepped in to bridge the gap by providing a cash-out refinance loan on a free and clear investment property in El Cajon, CA. This allowed the client to secure the necessary cash to close the purchase.

$1,430,000 1st DOT Refinance/Bridge Loan

A client referral wanted to expedite the construction loan process and needed a lender to accommodate them in providing a loan to build a single-family residence in Murrieta, CA.

$1,000,000 1st DOT Refinance/Bridge Loan

A repeat client needed to refinance an existing residential duplex investment property in San Diego as a bridge loan in preparation for adding additional units to the property.

$565,000 1st DOT Refinance/Bridge Loan

A client approached us seeking to refinance a single-family investment property in downtown San Diego. The borrower’s loan was maturing, and he needed to refinance it to allow time to sell the property.

$875,000 1st DOT Purchase/Bridge Loan

A new client approached us seeking to purchase a single-family investment property in Escondido, California, for $1,250,000. However, they desired a larger loan than we were willing to fund. Fortunately, the client owned another free and clear single-family investment property. By being flexible, Fidelis was able to meet the borrower’s loan request by cross-collateralizing both properties with a 1st trust deed.

$1,000,000 1st DOT Refinance/Bridge Loan

A repeat client acquired a single-family investment property in Oceanside, California, through a probate sale for $1,550,000. The purchase was financed with a seller carryback loan of $1,000,000 that now needs to be paid off. Since acquiring the property, the client has made significant improvements, increasing the value. Currently, the property is under contract to be sold for $2,300,000.

$350,000 2nd DOT Refinance/Bridge Loan

A repeat client needed funds to finish rehabbing an investment property. Instead of selling a property with substantial equity, the borrower requested a cash-out loan secured by a multi-family property just north of downtown San Diego, CA.

$1,175,000 1st DOT Purchase/Bridge Loan

A long-time client and repeat borrower needed funds to purchase a single-family residence in Los Angeles, where the client resides. The borrower also wanted a line of credit secured by two investment properties. Based on the strong client relationship, Fidelis was able to help the client.

$800,000 1st DOT Refinance/Bridge Loan

A repeat client needed to access the equity in a free and clear commercial land parcel entitled for a C-store, gas station, and car wash. Rather than selling the property, the borrower wanted immediate access to the equity via a cash-out refinance loan for other investment opportunities.

$375,000 1st DOT Refinance/Bridge Loan

A long-time client needed funds to take out a seller carry-back note and remodel an entry-level residential condo in El Cajon, CA.

$380,000 1st DOT Purchase/Bridge Loan

A returning client needed funds to purchase a dilapidated single-family residence in San Diego that will be remodeled and additional rental units added later. The borrower wanted to use his equity in another property as collateral to eliminate any cash required to close the transaction.

$600,000 1st DOT Purchase/Bridge Loan

A returning client needed funds to purchase a residential lot in Bonita, CA, where he plans to build rental units. The borrower wanted to use his equity in another property as collateral to eliminate any cash required to close the transaction.

Fidelis Private Fund provided the borrower a $600,000 1st Trust Deed purchase loan. The loan was cross-collateralized with four other properties, resulting in a Combined Loan-to-Value (CLTV) ratio of approximately 35%.

The exit strategy is a refinance with a construction loan once the permits to build the rental units are received.

$1,000,000 1st DOT Refinance/Bridge Loan

A returning client needed funds to purchase his business partner’s share in a commercial office building in Vancouver, Canada. Based on a long-time relationship, Fidelis was able to facilitate the request quickly with a cash-out refinance secured by a free and clear single-family investment property in La Quinta, CA.

$2,250,000 1st DOT Purchase/Bridge Loan

A client was seeking to purchase a multi-tenant retail strip center in Temecula, California, where they occupied a portion of the space as a tenant. The borrower wanted to limit the cash down payment and utilize additional equity in other properties owned as a way to maximize leverage.

$960,000 1st DOT Purchase/Bridge Loan

A repeat client was seeking a quick close to purchase a single-family investment property in the beach community of Encinitas, CA. This property offers the potential for added value in its existing dilapidated state.

$2,650,000 1st DOT Refinance/Const. Loan

A client referral was searching for a construction lender to fund the construction of nine apartment units that already included two newly remodeled single-family residences in front of the property in National City, California. Once complete, it will be an 11-unit multi-family property.

$1,325,000 1st DOT Refinance/Bridge Loan

An existing client needed a reliable lender to provide a bridge loan for the borrower, entitling the property for 30 apartment units on a prime property in the heart of Golden Hill, a community just east of Downtown San Diego.

$400,000 2nd DOT Refinance/Bridge Loan

A repeat client required a fast closing to pull cash out of an existing income property for another investment opportunity.

$480,000 1st DOT Purchase/Bridge Loan

A returning client required a fast closing to acquire a single-family investment property in San Diego. This property holds the potential for increased density by constructing multiple Accessory Dwelling Units (ADUs) at the rear of the premises.

$1,050,000 2nd DOT Refinance/Bridge Loan

A repeat client needed a construction loan to build one rental unit (ADU 3BR/2BA) on top of a two-car detached garage in the rear of the property fronting the alley in the Point Loma area of San Diego. There is an existing single-family residence in front of the existing two-car garage that will remain, and after completion, it will be two units with a detached two-car garage with a view of the ocean.

$475,000 1st DOT Purchase/Bridge Loan

A returning client, a real estate investor, requested a loan to buy a single-family home in San Diego with the potential for added value.

$480,000 1st DOT Refinance/Bridge Loan

A repeat client was in escrow to purchase a single-family investment property and needed a lender that would perform fast and accommodate a loan modification later in the loan term when permits were obtained for additional rental units in the form of Additional Dwelling Units (ADU’s) that will make it multi-family property.

$715,000 1st DOT Refinance/Const. Loan

A client referral wanted to expedite the construction loan process and needed a lender to accommodate an owner/builder in providing a loan to build a single-family residence in Chula Vista, CA.

$445,000 2nd DOT Refinance/Bridge Loan

A repeat client needed a construction loan to build one rental unit (ADU 3BR/2BA) on top of a two-car detached garage in the rear of the property fronting the alley in the Point Loma area of San Diego. There is an existing single-family residence in front of the existing two-car garage that will remain, and after completion, it will be two units with a detached two-car garage with a view of the ocean.

$644,000 1st DOT Purchase/Bridge Loan

A repeat client was in escrow to purchase a single-family investment property and needed a lender that would perform fast and accommodate a loan modification later in the loan term when permits were obtained to add 10 rental units in the form of Additional Dwelling Units (ADU’s) to make it a 12 unit multi-family property.

$1,020,000 1st DOT Purchase/Bridge Loan

A client referral needed to close fast on purchasing a single-family investment property in the community of Golden Hill, east of downtown San Diego. The property has the potential for increased density in the rear of the property with alley access.

$1,300,000 1st DOT Refinance/Const. Loan

A client referral wanted to expedite the construction loan process and needed a lender to accommodate an owner/builder in providing a loan to build a single-family residence in El Cajon, CA.

$800,000 1st DOT Refinance/Bridge Loan

A client referral needed to refinance an existing loan and take out additional funds to repair, remodel and add additional units by reconfiguring the 7,419 sf. industrial warehouse building located on a 10,555 sf. corner lot in San Diego.

$670,000 1st DOT Purchase/Const. Loan

A repeat client and general contractor needed a construction loan to build two, 2BR/2BA single-family residences with two car garages and a rooftop deck, both on the same block in the Ocean Beach community of San Diego.

$400,000 2nd DOT Refinance/Const. Loan

A repeat client needed a construction loan to replace a detached garage next to a fully remodeled single-family residence on a corner parcel with two rental units (1BR/1BA and 3BR/2BA ADUs) for a total of three rental units. The property is in the community of Point Loma, just east of downtown San Diego.

$2,600,000 Refinance/Const. Loan

A repeat client needed a construction loan to build a single-tenant retail building preleased with a long-term lease to the credit tenant Starbucks in Chula Vista, CA.

$315,000 2nd DOT Refinance/Const. Loan

A repeat client needed a construction loan to build two rental units (one ADU and a Jr. ADU) in one detached building on the back parcel with a fully remodeled single-family residence in the front for three rental units. The property is in the community of City Heights in San Diego, CA.

$150,000 2nd DOT Refinance/Bridge Loan

A repeat client needed a short-term loan to transform a 1BR/1BA rental unit into a 2BR/2BA unit on the same parcel as an existing single-family residential investment property that includes a total of two rental units in the community of Rancho Bernardo in San Diego, CA.

$2,200,000 Purchase/Bridge Loan

A repeat client needed a loan to acquire a mixed-use investment property located in San Diego County with significant added-value potential. The subject property consisted of 5 parcels totaling 11+ acres with 80 horse stalls and 13 rental homes. The purchase price was $2,610,000. The borrower plans to renovate and improve the property in two phases.

$475,000 Refinance/Bridge Loan

A referral from an excellent client needed a loan to buy out a partner on residential condominium investment property in La Jolla, CA, and needed to close fast. As an abundance of caution, the loan was also cross-collateralized with the owner’s single-family residence.

$500,000 Refinance/Line of Credit

A long-time client needed a lender to provide a line of credit to access cash for an investment opportunity in less than a week. The borrower owned a free and clear residential duplex investment property in San Diego, which was used as collateral to fund the loan.

$925,000 Refinance/Const. Loan

A repeat client owned three existing rental units in Logan Heights, a community near downtown San Diego, and needed a construction loan to add two additional units to transform the property into a commercial multi-family 5 unit property.

$625,000 Purchase/Bridge Loan

A repeat client was in escrow to purchase a 5,242 sq.ft. industrial building (warehouse/office) in San Diego, CA for $1,250,000, a below-market price, with a short escrow, and needed a lender to provide financing in less than two weeks. The property was 100% leased.

$200,000 Purchase/Bridge Loan

An excellent repeat client and experienced real estate investor was in escrow to purchase a residential investment property at a below-market price in Reno, Nevada and needed a lender that could close fast.

$400,000 Refinance/Bridge Loan

A client referral needed a quick cash-out loan for other investment purposes secured by a free and clear single-family residential investment property in Long Beach, CA.

$800,000 Purchase/Bridge Loan

A client referral and real estate investor needed a loan to acquire a dilapidated single-family residential investment property in San Diego with added-value potential. The borrower also wanted to utilize the equity capacity in another free and clear investment property as cash down for the investment.

$315,000 Refinance/Bridge Loan

A repeat Fidelis client, an owner-builder/contractor, built a single-family residence he owned free and clear. The borrower wanted a short-term cash-out loan.

$2,070,000 Refinance/Const. Loan

A repeat client purchased a single-family investment property on a large lot and obtained the entitlements to remodel the SFR and add six additional units creating substantial value. The borrower needed a construction loan to refinance the acquisition loan and provide funds for the construction of 6 additional units plus the SFR for a total of seven units.

$406,000 Refinance/Bridge Loan

A repeat client, businessman, and real estate investor needed an acquisition loan to purchase a large ranch property in San Diego County, including two single-family residences and outbuildings on one parcel. The borrower needed to close fast and needed a lender who could perform and meet the short deadline.

$500,000 Refinance/Bridge Loan

A repeat client who owned a mixed-use commercial property free and clear located in Spring Valley, CA, needed a loan to purchase the liquor store business that had leased the property for over 15 years. The improvements include a liquor store and a residential rental unit.

$200,000 Purchase/Bridge Loan

A client referral and real estate investor needed a loan to acquire a single-family residential investment property in San Diego with added-value potential. The purchase price was $840,000.

$1,860,000 Refi./Construction Loan

A repeat client needed a refinance/construction loan to pay off a private money loan secured by single-family investment property on a large lot. The borrower plans to remodel and obtain permits to add five additional rental units for a total 6-unit multi-family project.

$760,000 Refinance/Cash-Out/Bridge Loan

A client referral recently built a residential duplex in the community of Hillcrest in San Diego, CA, and owned the property free and clear. The borrower needed a quick cash-out loan to buy out his partner.

$750,000 Purchase/Construction Loan

An excellent client, a general contractor, was in escrow to purchase a residential investment property with the potential to add additional rental units to the property. The borrower also wanted to utilize excess equity capacity in a few other investment properties as cash down for the investment.

$566,250 Purchase/Bridge Loan

A repeat client needed to close fast on purchasing a single-family investment property in San Diego. The property has the potential for increased density with the construction of multiple ADUs in the rear of the property.

$300,000 Refinance/Cash-Out Loan

An excellent existing client referral owned a 100% leased, free and clear commercial property in Spring Valley, CA, that’s conservatively worth over $1,500,000 and wanted to use it as collateral to pull some cash out immediately for other investment purposes.

$260,000 Refi./Bridge Loan

A client referral owned a residential single-family investment property in El Cajon, CA, with a lot of equity and wanted to tap the equity for a cash-out loan for business purposes.

$300,000 Refinance/Line of Credit Loan

A new borrower referred to Fidelis by a reputable broker needed a commercial line of credit for investment purposes. The borrower had an investment property, owned free & clear, which he used as collateral for the subject line of credit.

$775,000 Refi./Construction Loan

A repeat client needed a creative lender to do a construction loan to construct 3 apartment units built out of containers on a vacant lot in San Diego.

$800,000 Refi./Rehab+ Loan

A repeat client who is a general contractor owns a single-family investment property in Oceanside, CA, and needed a loan to remodel the existing improvements and add two additional rental units (ADUs) turning it into a three-unit property, substantially increasing the value.

$100,000 Purchase/Bridge Loan

A client referral was in the process of purchasing a single-family residential four-acre improved lot for $485,000 in Poway, CA, just north of San Diego. The borrower was planning on purchasing all cash; however, due to unforeseen circumstances within 7 days of closing, the borrower was short $100,000 and needed a lender that could close fast.

$525,000 Refinance/Bridge Loan

A good client referred a borrower who was in need of refinancing a single-family investment property in Riverside, CA that was in foreclosure due to some unforeseen family issues.

$400,000 Refinance/Cash-Out/Bridge Loan

A borrower, well known to Fidelis, had an unfortunate tragedy in the family and inherited a free and clear residential condo in the community of Mission Valley in San Diego and needed a short-term, cash-out bridge loan within ten days.

$600,000 Refinance/Rehab Loan

A repeat client who is a general contractor here in San Diego owned a single-family investment property in Mammoth Lakes, CA, and wanted to do a significant remodel, doubling the rentable square footage into a 2,600 sq.ft., 4BR/3.5BA property.

However, he wanted a lender that would allow him to keep the $350,000 low-interest-rate 1st trust deed loan in place through the remodeling process.

$1,100,000 Purchase/Bridge Loan

A repeat client got their $1,420,000 offer accepted to purchase a five-unit multi-family property in Imperial Beach, CA. It had deferred maintenance and added value potential with a 10-day close.

$1,800,000 Refi./Construction Loan

A repeat client purchased a single-family investment property on a large lot with a conventional mortgage at a low-interest rate. At the same time, the borrower was in process of obtaining permits for a 6-unit multi-family project.

The borrower wanted to leave the low-interest rate 1st Trust Deed loan in place and get a construction loan that would go behind the 1st through the construction period. A request most lenders would not make.

$100,000 Refi./Cash-Out/Bridge Loan

A repeat client owned a single-family investment property free and clear and was in the process of a complete remodel. As they were approaching completion, the borrower was short on the liquidity to finish the remodel and needed a quick bridge loan for $100,000.

$487,000 Purchase/Rehab/Bridge Loan

A repeat borrower of Fidelis Private Fund was in a competitive bidding process for a single-family investment property in Spring Valley, a community of San Diego, which required a lot of rehab work. His ability to perform fast with a bridge loan from Fidelis won him the bid to purchase the property.

$550,000 Refinance/Rehab/Bridge Loan

A long-time borrower of Fidelis Private Fund needed financing to help finish the renovation of a 31-unit multi-family investment property he’s owned for years in the community of Mountain View in San Diego. The borrower has an excellent rate on the 1st Trust Deed loan, and it was in the borrower’s best interest to keep the loan in place.

$610,000 Purchase/Bridge Loan

A repeat client negotiated an excellent price to purchase a residential duplex on a large lot with plans to add eight additional dwelling units (ADUs) to the site for a total of 10 units. The purpose of the loan was to acquire the property and later provide additional funds to construct the additional units.

The buyer needed a lender to perform fast and accommodate the borrower later in the loan term when permits were obtained to amend the loan to provide the added value.

$620,000 Purchase/Bridge Loan

A long-time client was in escrow to purchase an office building in La Mesa that needed to close within 30 days and did not have time to get conventional financing. The buyer intends to occupy a majority of the space as part of expanding an existing business located across the street.

$600,000 Refinance/Bridge Loan

The borrower needed a creative bridge lender to help finish the rehab of a mixed-use project in downtown San Diego.

$705,000 Purchase/Bridge Loan

A repeat client needed to close fast on purchasing a single-family investment property in San Diego. The property has the potential for increased density with the construction of several ADUs in the rear of the property.

Fidelis will come in later and modify the loan to provide for some construction costs once the borrower gets the building permits.

$1,880,000 Purchase/Bridge Loan

A repeat Fidelis client who is a general contractor and a real estate investor needed a lender to provide acquisition financing to purchase a six-unit multi-family property within two weeks. Improvements included four detached bungalow units, one two-story duplex above five single car garages fronting the alley.

The plan is to remodel the existing six units, converting four of the single car garages to two additional units, and leave the one garage for storage.

$680,000 Purchase/Bridge Loan

A repeat client was in escrow to purchase a retail multi-tenant/residential mixed-use property in San Diego that needed to close within two weeks. The buyer intends to occupy a portion of the retail space as an owner-occupied property.

$300,000 Refinance Cash-Out/Bridge Loan

A referral from an existing Fidelis client needed some cash liquidity in anticipation of refinancing with a conventional lender on an existing 6 unit multi-family apartment that was recently remodeled with out-of-pocket funds from the owner.

$615,000 Purchase/Bridge Loan

A client referral was in escrow to purchase a commercial property with a ten-day close and is currently used as an autobody shop located south of downtown San Diego. The buyer intends to occupy the property with the same use as an owner-occupied property.

$1,840,000 Purchase/Const.Rehab/Bridge Loan

An experienced real estate investor needed a lender to purchase five detached residential cottages in poor condition and subsequently accommodate the borrower with additional funds to remodel the improvements and construct an additional ADU for a total of six units.

$1,900,000 Refinance/Const.Rehab/Bridge Loan

An experienced real estate investor needed a lender to purchase five detached residential cottages in poor condition and subsequently accommodate the borrower with additional funds to remodel the improvements and construct an additional ADU for a total of six units.

$560,000 Purchase/Bridge Loan

A repeat client needed to close fast on purchasing a single-family investment property in the community of South Park just east of downtown San Diego. The property has the potential for increased density with the construction of some ADU’s in the rear of the property with alley access.

$1,657,000 Purchase/Construction Loan

A repeat Fidelis client, real estate investor, and developer had an opportunity to purchase a vacant lot in an established residential neighborhood in Santa Cruz County, in Northern California. Our client has approved plans to build a 3,000+ sq. ft. spec home in the desirable Portola Valley area.

The borrower needed a lender to provide a construction loan to cover the purchase of the lot and the cost of construction. The loan to cost ratio was 71%, and a recent “as complete” appraisal resulted in a LTV of 53%.

$125,000 Purchase/Bridge Loan

A client was in escrow to purchase a residential investment property in the area of Mammoth Lakes, CA, for $192,000 and needed to bridge loan to close fast.

$335,000 Refinance/Const/Bridge Loan

A long-time client needed construction financing to add an ADU to two single-family investment properties in Fallbrook, CA, and needed a bridge lender to make it a smooth and seamless process. This is one of the two properties.

$345,000 Refinance/Const/Bridge Loan

A long-time client needed construction financing to add an ADU to two single-family investment properties in Fallbrook, CA, and needed a bridge lender to make it a smooth and seamless process. This is one of the two properties.

$862,500 Purchase/Bridge Loan

An experienced real estate investor and repeat client needed a quick bridge loan to purchase a single-family residential investment property in Pacific Beach and had to close in 10 days.

$700,000 Purchase/Bridge Loan

A repeat client purchased a residential investment property all cash and subsequently needed to refinance cash-out loan to purchase another investment property. The borrower wanted a creative and flexible bridge lender to utilize the equity in his existing property to purchase another investment property and, at the same time, provide funds for remodeling the subject property.

$875,000 Purchase/Bridge Loan

A repeat client, real estate investor, and entrepreneur wanted a purchase loan to acquire an office/warehouse industrial property as an owner-user. However, the borrower needed a creative and flexible lender to utilize equity in his other real estate to obtain a higher leveraged loan on the subject acquisition.

$270,000 Refinance/Const Loan

A client referred to Fidelis by a general contractor acting as an owner/builder needed a construction loan for a small single-family residential investment property in Julian, CA.

$480,000 Purchase/Bridge Loan

An existing client referred a borrower who wanted to quickly purchase an investment property as a rental to provide for a relative’s growing family needs.

$1,335,000 Purchase/Const./Bridge Loan

An experienced real estate investor and repeat client needed a loan to purchase a single-family residence (SFR) and the funds to increase the property’s value by building several ADU’s.

$2,100,000 Purchase/Bridge Loan

An experienced real estate investor and repeat client needed a bridge loan to purchase a 3-story, 21,168 sq.ft. office building within a six-building office park in Kearny Mesa.

With the investor’s extensive network of prospective tenants, the office building is in lease-up transition and expects to stabilize the property within the next 12 months.

$1,500,000 Refinance/Rehab/Bridge Loan

A repeat client purchased for all cash a single-family investment property out of foreclosure for $1.8M. After getting the permits and starting the remodel, the borrower needed a short-term loan to complete the major renovation.

$340,000 Refi/Bridge Loan

A repeat client needed to buy out a partner quickly on a single-family investment property in Escondido, CA, by refinancing the property and pulling cash out.

$1,500,000 Purchase/Bridge Loan

A repeat client needed a bridge loan to purchase 14 apartment units in El Cajon, CA, which required renovation before obtaining conventional financing.

The borrower needed a flexible bridge lender to fund the purchase quickly and allow time to vacate the tenants and complete the renovation.

$565,000 Purchase/Bridge Loan

A repeat client negotiated a below market price to purchase a single-family investment property in San Diego that required only some cosmetic improvements, and needed to close in less than 10 days.

The buyer needed a lender that would perform fast and make it an easy process.

$530,000 Purchase/Bridge Loan

A client referral was in escrow to purchase a commercial property to be used as an owner-occupied commercial property; however, tenants still in the property needed to be vacated before a conventional lender would fund the loan.

The borrower needed a flexible bridge lender to fund the purchase and allow time for the borrower to vacate the tenants and cure some deferred maintenance.

$150,000 Purchase/Bridge Loan

A referral from a Fidelis investor had the opportunity to purchase a fixer-upper single-family residence in San Diego and needed to close fast.

The buyer needed a lender that would perform within days and make it an easy process.

$675,000 Purchase/Bridge Loan

A borrower needed a bridge lender to fund the purchase of a mixed-use investment property with a commercial unit in front and two detached single-family residential units in the back.

The borrower needed a bridge lender that understood that the property was currently rented at under market rents and needed time to raise the existing rents to market and season the property to refinance with a conventional lender.

$700,000 Purchase/Bridge Loan

A repeat client was in contract for almost two years to purchase a single-family residence in the Bay Park area of San Diego with a locked-in purchase price of $825,000.

The buyer did not close on the transaction until July 2021 due to difficulty in removing the tenants. During that time, the property value when up over $500,000, creating an extremely profitable investment with the locked-in purchase price.

$600,000 Refinance/Rehab/Bridge Loan

A local San Diego client owns a residential lot free and clear in an upscale, residential neighborhood in Pasadena, CA. They have the opportunity to own a large single-family residence for free if they can move it off its foundation and onto the nearby residential lot they own.

The borrower needed a lender to provide a loan to cover the costs of moving the house and remodeling it after relocation. The lot value alone is $650,000, and once the home is moved and renovated, the subject property will be valued at over $2,000,000.

$590,000 Refinance/Bridge Loan

A repeat client owned a free and clear single-family investment property and needed to quickly access some of the equity in the property in the form of a cash-out refinance loan to purchase another investment property.

$675,000 Purchase/Bridge Loan

A client was in escrow to purchase five detached, single-family residences, bungalows in need of remodeling on one parcel in the South Park Community of San Diego. The purpose of the loan was to acquire the property, remodel the five cottages, raise the rents, and refinance with conventional financing.

$500,000 Purchase/Rehab/Bridge Loan

A repeat client owner/operator of a successful Auto Towing business was in escrow to purchase a multi-tenant industrial building for $1,500,000 as an owner user. The borrower owned the adjacent parcels to the east, so the purchase of the subject property enhanced the value of his business with the assembled parcels.

$1,100,000 Purchase/Bridge Loan

A repeat client owner/operator of a successful Auto Towing business was in escrow to purchase a multi-tenant industrial building for $1,500,000 as an owner user. The borrower owned the adjacent parcels to the east, so the purchase of the subject property enhanced the value of his business with the assembled parcels.

$595,000 Purchase/Bridge Loan

A repeat client negotiated an excellent price to purchase a single-family investment property with the plans to add additional dwelling units (ADU’s) to the site. The purpose of the loan was to acquire the property and later provide additional funds to construct improvements.

$310,000 Refinance/Const. Loan

A repeat Fidelis client, an owner-builder/contractor, built out of pocket a newly constructed single-family residence he owned free and clear that was partially finished. The borrower wanted a short-term loan to finish the construction.

$550,000 Purchase/Bridge Loan

A repeat client negotiated an excellent price to purchase a single-family investment property that needed cosmetic improvements.

The buyer needed a lender that would perform fast and make it an easy process.

$995,000 Refinance/Bridge Loan

A repeat client, an experienced real estate investor, and a general contractor needed cash liquidity for another investment opportunity. Instead of selling his property to access the cash, he wanted a refinance a cash-out loan from a lender that was quick and hassle-free.

$1,390,000 Refinance/Construction/Bridge Loan

An experienced real estate investor and client referral purchased several residential properties all cash, and over the past year, entitled the properties for additional rental units.

He now wanted to pull some cash out to purchase other investment property and have funds to remodel and build additional units on the subject property.

$1,265,000 Refinance/Construction/Bridge Loan

An experienced real estate investor and an excellent client needed a construction loan to transition a single-family residence into a multi-family property by keeping the house and converting the garage to a rental unit and constructing four units on the rear of the property for a total of 6 rental units.

$450,000 Purchase/ Bridge Loan

A repeat client and successful real estate broker was in contract to purchase a residential duplex with two detached residential units and needed to close in less than a week. The borrower is an experienced real estate investor and plans to remodel the improvements and increase the rents.

$560,000 Purchase/ Bridge Loan

A client referral was in contract to purchase a former neighborhood fire station in Fallbrook, CA, below-market. The borrower plans to remodel the improvements into a residential care facility or group home, which is believed to be the highest and best use.

$390,000 Purchase/ Bridge Loan

A repeat client negotiated below-market price to purchase a single-family investment property that needed some cosmetic improvements

$1,155,000 Purchase/ Bridge Loan

A repeat client needed to close on the purchase of a residential duplex investment property in less than a week. It was a historical residence in the community of Golden Hill, San Diego. The borrower had some cash from a 1031 exchange and a lot of equity tied up in another residential investment property owned in La Jolla.

$407,000 Purchase/ Rehab Bridge Loan

A repeat borrower who is an experienced general contractor needed a quick bridge loan to purchase a single-family investment property with a San Diego bay view. It needed to close in less than a week.

$1,425,000 Refinance / Bridge Loan

The owners own and operate an adult residential care facility. They needed to refinance to pay off a partner before they could refinance with an approved SBA loan. They needed to close fast.

$200,000 Refinance / Rehab / Bridge Loan

A client purchased two investment mixed-use properties for $650,000 with a seller carry-back note of $475,000. The properties were rented at below-market rents. The borrower needed a bridge lender to fund $200,000 in rehab costs to generate market rent.

$210,000 Refinance / Bridge Loan

A repeat client needed to pay off a 2nd Trust Deed loan that had matured secured by a single-family property. As a way to expedite the process, the borrower offered to provide a 1st Trust Deed on a single-family investment property owned free and clear

$550,000 Purchase / Bridge Loan

A repeat borrower needed a quick bridge loan to purchase a single-family investment property in Oceanside, CA, that needed to close in less than two weeks. The borrower wanted to use the equity in his properties in lieu of cash down in structuring the financing for the purchase.

The purchase price was $600,000. The borrower already had a buyer in contract to purchase the property for $675,000 once the loan was closed.

$420,000 Refinance / Bridge Loan

A client needed a bridge loan to refinance an existing private loan and fund the remaining costs to complete two manufactured homes on two separate parcels.

The two manufactured homes were built and ready to be moved onto the site. The appraised value of the two houses was $700,000 or $350,000 each.

$1,550,000 Purchase / Bridge Loan

The borrower needed a quick bridge loan to purchase an industrial warehouse/office building that would be owner-occupied. Their SBA loan with the Bank was approved but could not fund in time to meet the seller’s deadline to purchase the property.

$270,000 Purchase / Bridge Loan

The timing was right for our borrower when they found an off-market opportunity to purchase an affordable single-family fixer-upper investment property below market value. The seller needed to sell quickly.

$245,000 Purchase / Bridge Loan

A repeat client negotiated a below-market price to purchase a single-family investment property that needed to close within a week. The borrower planned to remodel the house for resale.

$400,000 Purchase / Bridge Loan

An existing Fidelis borrower and Fidelis investor, experienced business owner, and real estate investor purchased an owner-occupied commercial property in Riverside, CA. He needed a quick bridge loan to buy a property that will be refinanced with conventional financing.

$150,000 Refinance Cash-Out / Bridge Loan

A previous client owned a single-family residential investment home free and clear, recently remodeled and ready for sale, and needed $150,000 cash out to pay off another investment debt.

The conservative market value of the property was $890,000 or a 17% LTV ratio. The property was in an excellent San Diego residential neighborhood with great views.

$500,000 Purchase / Bridge Loan

A prior client, experienced business owner, and real estate investor teamed with a partner. They needed a quick bridge loan to purchase a commercial property/owner-occupied in a matter of days.

The purchase price was $700,000 or 71% loan to cost. An appraisal supported the value after the remodel of $860,000 or 58% LTV. The borrower was pre-approved for an SBA loan, but the SBA loan could not close in time for the borrower to purchase the property.

$295,000 Purchase / Bridge Loan

An existing client referred a borrower to Fidelis, a business owner who needed a bridge loan to purchase a commercial property.

The purchase price was $430,000 or 68% loan to cost. The property location is in a transitioning area once a residential home is now zoned commercial and used for commercial purposes. Once re-tenanted for occupancy, it is conservatively valued over $500,000 or 59% LTV.

$300,000 Refinance / Const. Loan

A repeat Fidelis client, an owner-builder/contractor, needed a construction loan to complete a single-family investment property. The market value of the completed property is conservatively estimated based on sale comps at $600,000 or 50% LTV.

$450,000 Purchase / Bridge Loan

A repeat client negotiated another below-market price to purchase a single-family investment property that needed little to no work.

This type of investment opportunity is hard to come by these days when there is not a lot of improvements to be done to create value. The buyer was scheduled to close in a few days and needed a lender that would perform and make it happen.

$210,000 Purchase / Rehab Bridge Loan

A referral from a long time client needed to close on the purchase of a large single-family investment property in Spring Valley, CA, in less than one week with a conservative loan at 24% LTV.

$845,000 Purchase / Rehab Bridge Loan

The subject borrower came from an existing client referral. The investor needed a loan to purchase a “Fixer-Upper” single-family residential investment property in the excellent community of Kensington in San Diego, CA.

$750,000 Refinance / Bridge Loan

A referral from an existing client needed a refinance cash-out bridge loan. The purpose was to recoup a portion of an all-cash purchase of a residential condo investment property with oceanfront views in La Jolla, CA.

$938,000 Purchase / Const. Loan

Two partners, a general contractor and repeat client, and a real estate investor, needed a construction loan to build two residential units in San Diego, CA. The acquisition included one parcel with the lot being split into two separate lots creating added value.

$555,000 Purchase / Rehab Loan

An experienced real estate investor and repeat client needed a loan in a matter of days to purchase a “Fixer-Upper” single-family residential investment property in Chula Vista, CA.

$770,000 Purchase / Bridge Loan

A repeat client needed a bridge loan to purchase a single-family investment property in the Hillcrest Community of San Diego. It was the third of three properties the borrower purchased that were all contiguous to each other. The borrower assembled the three properties to be sold to a developer for a multi-family project.

$150,000 Refinance Cash-Out / Bridge Loan

A long time client and business owner of a multi-tenant commercial property in Laguna Beach, CA, had most of his cash liquidity tied up in equity in the property. He was in the process of restructuring the debt on the property and needed to pull some cash out to accomplish his goal.

$450,000 Refinance Cash-Out / Bridge Loan

A successful real estate investor wanted to tap cash equity in his properties to purchase another income property. Rather than selling a property to obtain the cash, he wanted a lender to consider refinancing a few of his existing properties to pull cash out as the equity to purchase a 6 unit apartment.

$545,000 Purchase / Bridge Loan

A repeat client negotiated a below-market price to purchase a “Fixer-Upper” single-family residential investment property in an excellent location in the Del Cerro community of San Diego. The borrower had to close in a matter of days and needed a lender that would perform fast and make it an easy process. A short Video is included.

$300,000 Refinance / Bridge Loan

A repeat client needed a loan to rehab a dilapidated single-family residence with one detached residential unit and garage in the rear of the property. The property is located on a corner lot in an excellent location in the community of Pacific Beach on Grand Avenue.

$590,000 Refinance / Construction Loan

An experienced general contractor needed a construction loan, as an owner/builder, to build a residential duplex with an auxiliary unit for a total of three residential units in an excellent location in the community of South Park San Diego.

$361,250 Purchase / Bridge Loan

An experienced real estate broker negotiated a below-market price to purchase a “Fixer-Upper” single-family residential investment property in San Diego, CA. The borrower needed a lender who would acknowledge the real market value vs. just focusing on the purchase price. She needed a lender that would listen to the story and recognize the real market value.

$918,750 Purchase / Bridge Loan

A repeat Fidelis client needed a bridge loan to close on the purchase of a single-family residence in La Jolla, CA. The borrower qualified for a permanent loan with a conventional lender, but the seller would not extend the escrow long enough to close with the traditional financing.

$1,140,000 Refinance / Construction Loan

Two partners, a general contractor and real estate investor, needed a construction loan to build two detached residential duplexes in Vista, CA. A total of four apartment units.

The borrower’s obtained the permits necessary to start construction and were ready to build. They and did not want to wait and go through the conventional, institutional financing process and further delay the project start date.

$195,000 Purchase / Bridge Loan

A borrower had an opportunity to purchase a commercial investment property located in Lakeside, CA, at an excellent price and needed to close fast.

$300,000 Refinance / Bridge Loan

A borrower needed to access cash equity in an existing residential investment property located in Escondido, CA, to purchase another business investment. Instead of having to sell the property, the borrower wanted to refinance and pull cash out as well as use his personal residence as additional collateral as an “abundance of caution.”

$300,000 Refinance / Bridge Loan

A repeat Fidelis client, owner-builder/contractor, needed to access cash equity in a newly constructed single-family residence he owned free and clear. The borrower wanted a short term cash-out loan for other investment opportunities.

$900,000 Construction / Bridge Loan

An experienced general contractor and repeat client needed a construction loan to build two detached single-family investment properties in North County San Diego. The borrower had previously split a parcel with a single-family residence on it into three parcels leaving two vacant parcels to build two new homes.

$200,000 Purchase / Bridge Loan

A repeat client negotiated a below-market price to purchase a “Fixer-Upper” single-family residential investment property in El Cajon, CA. The borrower had to close fast and needed a lender that would perform and make it an easy process.

$200,000 Purchase / Bridge Loan

A repeat client needed a quick, short-term loan to purchase a single-family residential investment property in the San Diego area. The borrower secured the purchase at an excellent price and planned to make cosmetic improvements to the property for resale.

The purchase price was $432,000, and the borrower put down 54% of the purchase price or $232,000, with a conservative $200,000 loan.

$180,000 Purchase / Bridge Loan

An aspiring real estate investor needed a quick, short-term loan to purchase a single-family residential investment property in the San Diego area. The borrower secured the purchase at a below-market price and planned to make cosmetic improvements to the property for resale.

The purchase price was $455,000, and the borrower put down 60% of the purchase price or $275,000, a very conservative loan most any lender would do.

$320,000 Purchase / Bridge Loan

A repeat client and experienced real estate investor had an opportunity to purchase a single-family residence in El Cajon, CA as an investment property at below market value. The plan was to add value by converting a garage into a detached ADU (Accessary Dwelling Unit) and hold as a rental property.

$405,000 Purchase / Bridge Loan

A real estate investor had an opportunity to purchase a single-family residence in the San Diego area as fix & flip investment property and needed to close within a week. Fidelis Private Fund moved fast and provided a $405,000 short term 1st Trust Deed or a 70% LTV ratio.

$250,000 Refinance / Rehab / Bridge Loan

Fidelis Private Fund moved fast and funded a $250,000 short term 1st Trust Deed loan structured with a $100,000 initial advance with the $150,000 held for the remodel and improvement costs.

$415,000 Purchase / Bridge Loan

Fidelis Private Fund was able to move fast and closed a $415,000 short term 1st Trust Deed loan on the duplex and cross-collateralized the loan with the apartment to provide the funds to purchase and rehab the duplex or conservatively at a 57% combined loan to value.

$287,000 Purchase / Bridge Loan

An experienced mortgage broker who is also a Fidelis client was in the process of providing conventional financing for the purchase of a $410,000, single-family investment property for one of his clients. Just before closing, the lender was not able to perform. The borrower needed another lender that would come in and provide a loan for a quick close so that she would not lose the investment opportunity.

$350,000 Refinance / Bridge Loan

The Fidelis Private Fund loan helped the borrower access cash equity in a property that was owned free and clear, allowing him to use the proceeds to profit on another investment opportunity.

$375,000 Acquisition / Bridge Loan

The Fidelis Private Fund stepped in to help the borrower acquire an underperforming asset creating immediate equity with the purchase price less than the ‘as is’ market value. Also, once stabilized occupancy is achieved considerable value will be added.

$250,000 Refinance / Bridge Loan

Fidelis Private Fund closed a $250,000,000 short term 2nd Trust Deed loan. The income approach to value once stabilized as a for lease parking lot results in a conservative market value of over $2,000,000 or a 44% LTV ratio (combined 1st & 2nd).

$900,000 Refinance / Construction Loan

A referral from a repeat client was in escrow to purchase a stand-alone industrial warehouse/office building in an industrial park that would eventually be an owner-occupied, single-tenant property. The borrower wanted a lender that would perform and make it an easy loan process.

$650,000 Acquisition / Mini-Perm Loan

Fidelis Private Fund, provided a 1st Trust Deed, three-year loan of $650,000 or 68% LTV. The exit strategy is a refinance with a conventional lender once it is owner-occupied and stabilized.

$750,000 Loan (Participation) $1,500,000 Acquisition / Bridge Loan

An experienced real estate developer/repeat client was in escrow to purchase an entitled and improved commercial land parcel for $3,150,000 in Cota de Caza, CA, a community east of Mission Viejo in Orange County. The borrower plans to construct approximately 18,000 sq.ft. of commercial space in three buildings. The three buildings are essentially 100% preleased and scheduled to start construction early 2020.

$550,000 Acquisition / Bridge Loan

Fidelis Private Fund provided a $550,000 short term loan or 69% LTV. The borrower plans to remodel and expand the SFR and develop the adjacent vacant lot (separate parcel) with a detached SFR.