As the real estate environment shifts quickly, waiting on a bank’s lengthy approval process can mean losing out on prime investment opportunities. Traditional lenders often impose rigid requirements, slow decision-making, and inflexible terms that can stall progress. This is where private lending steps in as a game-changing alternative, offering speed, flexibility, and strategic growth opportunities for real estate investors and developers.

The Pitfalls of Traditional Lending

For many borrowers, securing financing through a bank is an uphill battle. Here’s why:

For many borrowers, securing financing through a bank is an uphill battle. Here’s why:- Stringent Qualification Criteria – Banks demand extensive financial documentation, high credit scores, and strict debt-to-income ratios, making approvals difficult for entrepreneurs and investors.

- Slow Approval Process – Traditional loans can take weeks, sometimes months, to get approved—by then, an attractive deal may be long gone.

- Limited Flexibility – Bank loans come with rigid terms and structures that don’t accommodate the dynamic needs of real estate investors.

- Missed Opportunities – If financing isn’t secured quickly, investors risk losing out on lucrative properties and development projects.

The Private Lending Advantage: Speed, Flexibility & Growth

Private lending provides a viable solution that enables investors to act fast, remain competitive, and strategically scale their businesses.

1. Fast Approvals & Quick Funding

Unlike banks, private lenders focus on the asset’s value rather than just the borrower’s financial profile. This allows for streamlined underwriting and faster approval times—often within days. At Fidelis Private Fund, our financing process is designed to move at the speed of business, ensuring that investors can capitalize on opportunities without delay.

2. Tailored & Flexible Financing Solutions

Every real estate deal is unique, requiring financing that adapts to specific needs. Private lending offers:

-

-

Bridge Loans – Ideal for quick-turnaround projects and short-term capital needs.

-

Construction Loans – Supporting ground-up developments with efficient funding structures.

-

Value-Add Project Loans – Perfect for renovations and repositioning strategies that boost property value.

-

ADU Financing – Streamlined funding for accessory dwelling unit (ADU) construction, a growing market trend.

-

With Fidelis, borrowers receive customized loan structures that fit their project goals rather than being forced into a one-size-fits-all bank loan.

3. Common-Sense Underwriting

Private lenders prioritize real estate potential over bureaucratic red tape. Instead of focusing solely on credit scores, our underwriting process at Fidelis Private Fund evaluates the viability of the investment itself—making it easier for borrowers to secure funding even if they don’t meet traditional bank criteria.

4. Competitive Edge in a Fast-Moving Market

Real estate success often comes down to speed. Being able to close quickly means outperforming competitors and locking in prime deals before others. With Fidelis, investors can secure pre-approved capital, ensuring they have access to funds when the right opportunity arises.

Why Fidelis Private Fund?

At Fidelis, we specialize in empowering real estate investors and developers with creative financing solutions. Our relationship-based approach means:

At Fidelis, we specialize in empowering real estate investors and developers with creative financing solutions. Our relationship-based approach means:-

-

Pre-approved capital for repeat borrowers, enabling smoother transactions.

-

Transparent terms with no last-minute surprises.

-

A team that understands real estate and actively works to help investors succeed.

-

With a strong foundation built on trust, integrity, and efficiency, Fidelis Private Fund is dedicated to helping clients navigate financing challenges and unlock strategic growth opportunities.

Secure Your Competitive Advantage with Private Lending

For personalized guidance, connect with our team today. Call Fidelis Private Fund now at 760-258-4486 and schedule a meeting with our experts to discuss your investment goals. Our experienced team has helped countless investors navigate market uncertainty and build resilient portfolios with confidence. Let’s build a secure and profitable financial future together.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Latest Performance Report

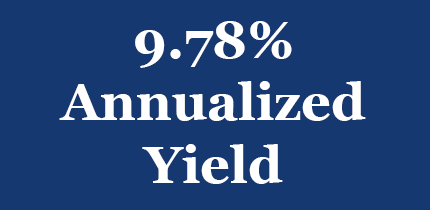

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 1st Quarter 2025. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.