Investing in Fidelis Private Fund

The annualized yield to investors is not guaranteed, and past performance does not predict future results. We prioritize risk mitigation with a conservative portfolio target of 60% overall loan-to-value ratio.

Since inception, Fidelis Private Fund has offered investors an attractive way to invest in real estate secured loans generating a competitive, consistent rate of return paid quarterly.

Investor Resources

The heart of Fidelis Private Fund is funding 1st deeds of trust on real property with loan amounts of $250,000 to $3 million. Lear more about Trust Deeds and how Fidelis anchors its lending activity in this strategy.

What do we Do?

What do we Do?

Fidelis Private Fund, LP serves accredited investors seeking a fixed income investment in commercial and residential real estate loans. Trust deed investments are secured by real estate property, reducing the risks that can be associated with private money investing.

Who are Our Investors?

The fund welcomes inquiries from accredited investors, trusts, financial advisors, those seeking to invest with IRAs, and other investment firms.

A Unique Value for Investors

The Fidelis Private Fund investment is not in any one loan or property. Risk is reduced and opportunity increased, because of a diverse portfolio of multiple loans and property types. There is no yield guarantee, however, Fidelis Private Fund currently offers a yield of 9%+.

Fidelis Private Fund at a Glance

9.43%

Annualized Investor Yield YTD

180+

Investor Accounts

$74M+

Investor Capital

Investor Benefits

Excellent Yield

Excellent Yield

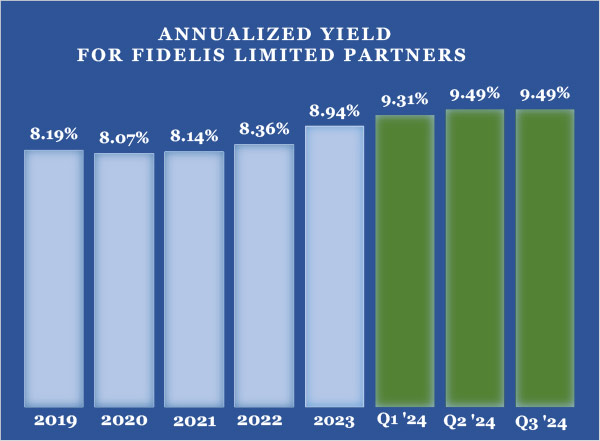

The fund, since its inception has generated a competitive annualized yield of over 8%.

Security

Security

Investments are secured by hard, tangible diversified real estate assets, the majority of which are 1st Trust Deeds.

Experienced Fund Manager

Experienced Fund Manager

John Lloyd has successfully navigated a mortgage fund through some of the worst recessions in our history,

Acceptable Liquidity

Acceptable Liquidity

Provided (capitalized) upon availability and advanced notice with exceptions to protect the integrity of the Fund

Risk Mitigation

Risk Mitigation

LTV average – 59%. Loan Loss reserve – 2%+ of total loan commitments. Short-term loans hedge against inflation.

Geographic Focus

Geographic Focus

Lending area is mainly California, primarily San Diego County Real Estate

Flexible Income Distribution

Flexible Income Distribution

Quarterly interest income or funds can compound monthly

General Management

General Management

The General Partners have a vested interest in Fidelis Private Fund with over $6 million of the total capital invested,

What Others Say About Fidelis Private Fund

Fidelis Private Fund

Investment Terms

Investment Terms

- Minimum investment of $50,000 and a 1-year commitment with a 10% withdrawal fee before year one.

- No fees are charged on investor capital for either the initial investment or the withdrawal.

How the Fund Works

How the Fund Works

- Fidelis Private Fund, LP is a California Limited Partnership.

- Investors are Accredited Limited Partners.

- Majority of the loans are secured by 1st Trust Deeds on commercial and residential investment real estate.

- Short term loans reduce interest rate risk and hedge against inflation.

- Quarterly interest income distribution or choose to allow the funds to compound monthly.

- Liquidity provided upon availability and advanced notice with exceptions to protect the integrity of the Fund.

Management

- The General Partner is Fidelis Private Fund, Inc. with four shareholders: John Lloyd, Chad Ruyle, Jon Maddux, and Sam Attisha.

- All four owners of the General Partner of FPF are investors in the Fund.

- Experienced, seasoned, and proven leadership.

- The General Partner of the fund is compensated by participating in the net income of the Fund, thereby sharing in the expenses of the Fund.

- There is an Accountability Committee made up of a select group of investors that serves management in an advisory capacity.

Investment Philosophy

Investment Philosophy

- A reserve for bad debts will be established and funded monthly to mitigate loan risk.

- Risk is spread over multiple loans and product types diversifying the loan portfolio.

- Geographical lending area is primarily California with a focus on San Diego County.

Keys to the Fidelis Investment Opportunity

Fidelis Private Fund offers prospective investors a unique and investment opportunity. We have the expertise and experience to capitalize on the market inefficiencies using strong underwriting fundamentals and a disciplined approach to capital preservation to maximize the return to our investors. Since 2019 a growing community of investors has discovered the benefits of Fidelis Private Fund. Below is a list of advantages and those benefits.

Yield

A strong consistent quarterly return for income or compounding...

The fund, since its inception has generated a competitive annualized yield of over 8% and over the past 4 quarters above 9%..

Security

We have had zero foreclosures since inception...

Investments are secured by hard,

tangible diversified real estate assets, the majority of which are 1st Trust Deeds.

Experienced Fund Manager

You can have confidence in the Fund's leadership...

John Lloyd has successfully navigated a mortgage fund through some of the worst recessions in our history with no investor capital loss.we perform!

Acceptable Liquidity

Your pincipal is secure and available...

Provided (capitalized) upon availability and advanced notice with exceptions to protect the integrity of the Fund

Investor Inquiry

Fidelis Private Fund serves accredited investors seeking a fixed income investment in a portfolio of diversified real estate secured loans generating a competitive, consistent return. We welcome accredited individual investors, trusts, LLC’s, Corporations, and also those seeking to invest with IRA’s, 401-K plans, and profit-sharing plans.

The minimum investment is $50,000 and a 1-year commitment with a 10% withdrawal fee before one year. There are no fees charged on invested capital for either the initial investment or the withdrawal. As distinctive compared to many funds, the Fidelis Fund manager is accountable to an advisory board that meets quarterly. The board is made up of the owners and key investors acting in an advisory capacity.

Thank you for your interest in Fidelis Private Fund. We look forward to hearing from you and seeing if you qualify as an accredited investor.