TO LISTEN INSTEAD OF READING THIS BLOG, CLICK ON THE ICON BELOW![]()

Should You Bet on Real Estate or the Stock Market?

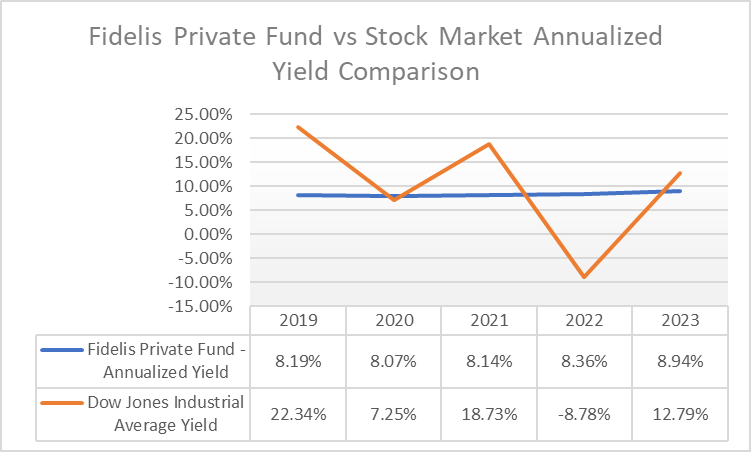

This comparative analysis highlights the advantages of investing in real estate through a mortgage fund like Fidelis over the stock market, mainly focusing on the relative stability and potential for consistent returns when your investment is secured by real estate.

The Enduring Stability of Real Estate

The Enduring Stability of Real Estate

Investing in mortgage funds secured by real estate offers distinct advantages over the stock market. The primary benefit lies in its enduring stability; real estate presents a more predictable and steady investment landscape than the often volatile stock market. This stability is underpinned by the predictable appreciation of real estate values over time, providing a more reliable path to wealth accumulation in contrast to the quick and unpredictable fluctuations typical of stock investments.

Another significant advantage to investors is that it offers a consistent return less influenced by market swings, unlike stock dividends, which can vary with company performance and market conditions. Additionally, real estate loans secured by real estate, as in a mortgage fund, typically present a lower risk profile than stocks, which is attributed to their tangible nature and historical resilience during economic downturns.

Since its inception, Fidelis has generated a consistent annualized yield to investors of over 8% compared to a volatile stock market yield, as shown in the graph below:

Investing in a mortgage fund means your money is secured by real estate, which tends to be more stable than the stock market. This stability makes it an attractive option for those who want to preserve and grow their wealth. Additionally, including real estate in your investment portfolio can help diversify your assets, protect against inflation, and lower your overall risk.

Conclusion

While the stock market offers high liquidity and the potential for rapid gains, it comes with higher risk and volatility. In contrast, real estate, particularly through mortgage funds like Fidelis Private Fund, provides a more stable and long-term investment avenue. It’s preferable for investors seeking a balance of stability, growth, and long-term wealth accumulation.

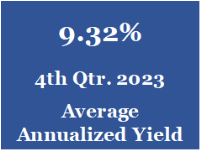

Fidelis Private Fund annualized yield paid to Limited Partners for the fourth quarter of 2023 was 9.32%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the fourth quarter of 2023 was 9.32%. Click here for a summary of Fidelis’s annualized yield since inception.