$550,000 1st DOT Purchase/Bridge Loan

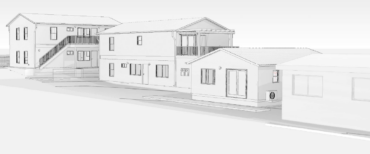

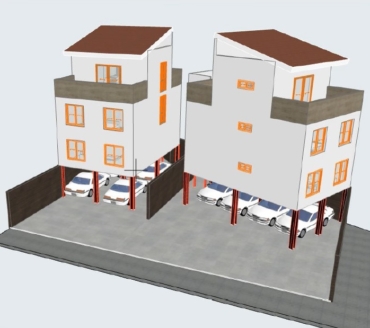

A repeat client and experienced real estate investor wanted to tap into his existing real estate equity to purchase a single family residential investment property in Chula Vista, CA as a fix and flip with almost no cash down. The borrower owned other investment properties with substantial...