What is a Bridge Loan?

Why Are Bridge Loans Essential in Real Estate?

Why Are Bridge Loans Essential in Real Estate?

-

Speed: Unlike traditional loans, which can take weeks or even months for approval, bridge loans are designed for quick disbursement. This allows you to act decisively and secure properties before competitors do.

-

Flexibility: These loans are tailored to meet unique financial needs. Whether you’re acquiring property or bridging the gap between two project phases, bridge loans offer terms that align with your timeline.

-

Peace of Mind: By eliminating financial uncertainty, bridge loans allow you to focus on the bigger picture—executing your vision and growing your portfolio.

How Do Bridge Loans Work?

-

Short-Term Duration: Fidelis bridge loans have terms ranging from six months to two years, offering just enough time to complete your transition.

-

Collateral-Based: These loans are secured against the property you’re purchasing or an existing real estate asset, giving lenders assurance while streamlining the process. Fidelis will often consider cross collateralizing property if needed to help the borrower accomplish their goal.

-

Higher Costs, Greater Benefits: While bridge loans have higher interest rates than traditional financing, their speed and flexibility make them a practical solution for time-sensitive situations. Savvy borrowers understand that the higher costs are off-set by the profit potential of the project.

Who Benefits from Bridge Loans?

-

Real Estate Developers: If you’re managing multiple projects or need immediate capital to begin construction, a bridge loan ensures no opportunities are lost.

-

Investors: Whether flipping houses or expanding your portfolio, bridge loans provide quick financing to secure properties in competitive markets.

-

Homeowners in Transition: If you’re purchasing a new home, which would be treated as an investment property while waiting to sell your current property, a bridge loan helps you transition smoothly without financial strain.

Key Considerations Before Opting for a Bridge Loan

-

Assess Your Timeline: Ensure the short-term nature of a bridge loan aligns with your goals and the expected timeframe for refinancing or asset liquidation.

-

Understand the Terms: Transparency is key. Review loan terms, including interest rates, fees, and repayment schedules to avoid surprises. Borrowers should be clear about how the loan fits into their financial strategy.

-

Calculate ROI: Evaluate whether the potential return on your investment justifies the cost of the loan. Consider how the flexibility and speed of bridge loans can unlock opportunities that might otherwise be missed.

-

Prepare for Repayment: Have a clear exit strategy for repayment of the loan, whether it involves short-term refinancing, selling an asset, or securing long-term financing. This step is essential in the process to obtaining the right bridge financing.

Why Timing Matters in Real Estate Financing

Final Thoughts

Understanding bridge loans is the first step in making them work for you. With the right knowledge and resources, timing gaps in your projects no longer have to mean missed opportunities, —they can become stepping stones to success.

Timing is everything in real estate, and bridge loans provide the speed, flexibility, and tailored solutions you need to stay ahead in competitive markets. If you’re ready to overcome timing challenges and turn opportunities into success, Fidelis Private Fund is here to help. Contact us at 760-258-4486 today to explore how our bridge loan solutions can support your next real estate venture and keep your projects moving forward.

Visit fidelispf.com or call us at 760-258-4486 to learn how Fidelis can help you achieve stability and consistent growth in your portfolio.

See Our Most Q4 2024 Performance Report

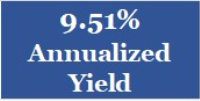

Fidelis Private Fund annualized yield paid to Limited Partners for the 4th quarter 2024. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the 4th quarter 2024. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

Fidelis 2028 Vivid Vision – Where are we going and how are we going to get there!

The Fidelis 2028 Vivid Vision document provides a comprehensive blueprint of the company’s strategic direction, core values, and operational principles, highlighting its commitment to capital preservation, growth, innovation, and client-centric services. Click to read the Fidelis vision.