TO LISTEN INSTEAD OF READING THIS BLOG, CLICK ON THE ICON BELOW![]()

In the investment realm, the temptation of high immediate returns often masks the significance of consistent, long-term gains. The legendary fund manager Howard Marks, co-founder of Oaktree Capital Management and a pivotal figure in alternative investments, exemplifies this. Although his annual returns rarely topped the charts, over 14 years, his investments ranked in the top 4% overall, underscoring the superiority of steady performance and the compounding effect over short-term high returns.

The Misleading Charm of Short-Term Gains

Investors are often captivated by making the most at any given moment. The question, “What is the best return I can earn now?” seems intuitive. However, this approach is akin to sprinting in a marathon; it’s unsustainable and often leads to burnout or missed opportunities.

The Magic of Consistency and Compounding

The true magic in investing, much like in evolution, occurs over time. The key is understanding the mathematics of compounding. The most crucial question isn’t where you can earn the highest return immediately but what competitive returns you can sustainably achieve over a long period. The consistent accumulation of returns, not their sporadic spikes, builds wealth.

The Evidence in Numbers

The fund manager’s story cited by Howard Marks is a clear illustration. While never a star performer in any single year, the consistency of good returns over time placed him among the top echelon over a longer horizon. This is a classic example of the tortoise beating the hare, a principle as old as time but often forgotten in the haste to achieve immediate results.

The Path to Extraordinary Returns

The Path to Extraordinary Returns

Good returns sustained over a long period have the potential to generate extraordinary wealth. This approach reduces the risk of losses from short-term market fluctuations and allows investors to benefit from the snowballing effect of compounding interest. In other words, it’s not just about how much you make but how consistently you make it and for how long.

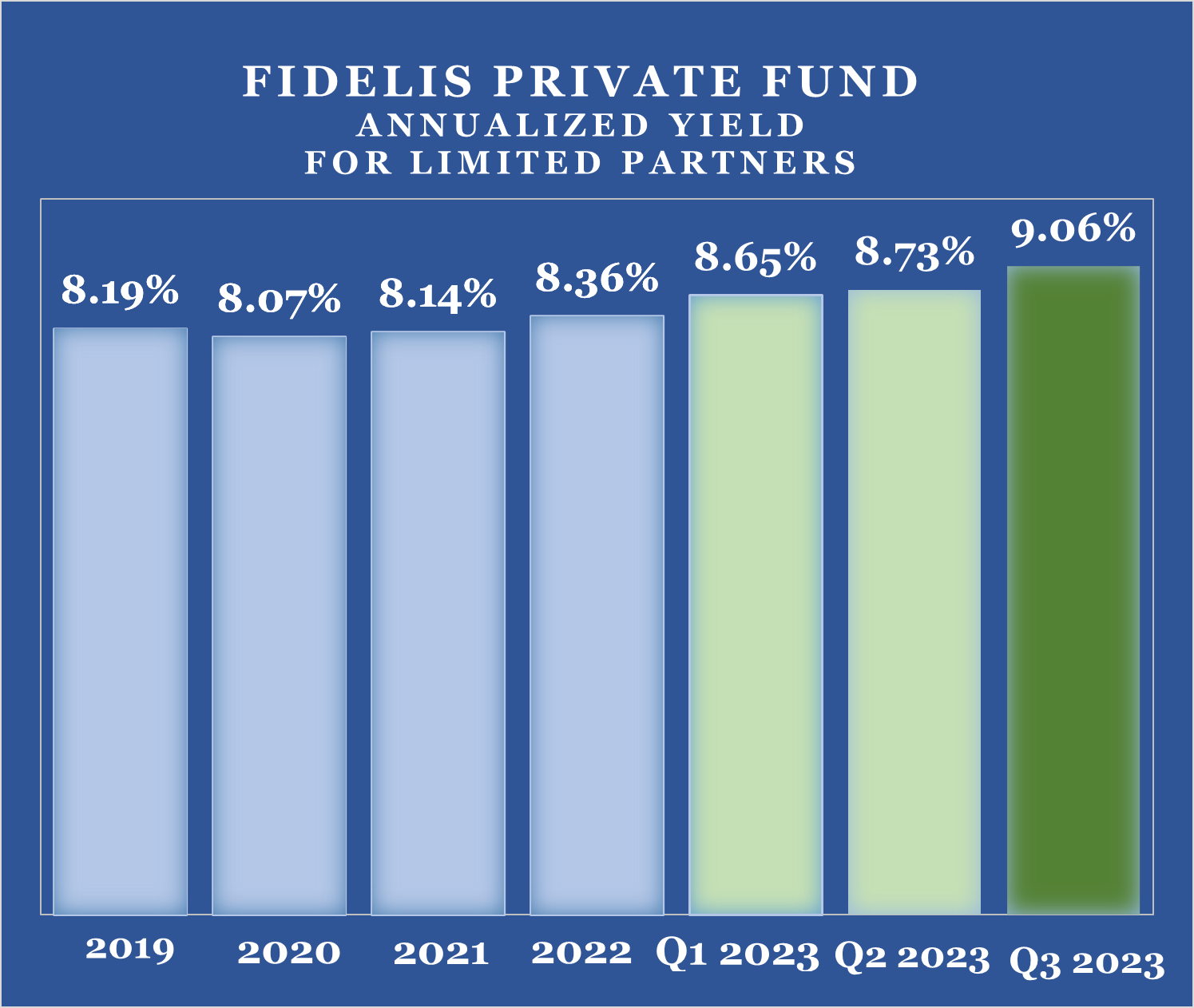

Since its inception, Fidelis Private Fund has provided our investors with consistent and competitive returns. Furthermore, for 12 years before establishing Fidelis, I managed a mortgage fund where we consistently delivered an 8% annualized return. Our investors have always been able to rely on this stability and consistency for the growth of their investment portfolios.

Conclusion

While the quest for the highest return at any given point is understandable, the sustained, consistent returns over a more extended period truly build wealth. Like the fund manager who, without fanfare, outperformed most over 14 years, investors should focus on the long game. In investing, as in life, patience and consistency are often the keys to extraordinary success.

Fidelis Private Fund annualized yield paid to Limited Partners for the Month of October was 9.35%. Click here for a summary of Fidelis’s annualized yield since inception.

Fidelis Private Fund annualized yield paid to Limited Partners for the Month of October was 9.35%. Click here for a summary of Fidelis’s annualized yield since inception.